In today’s fast-paced business environment, credit card payments are essential, but the associated fees can quickly eat into your profits. Many small businesses are seeking ways to minimize these costs, and that’s where free credit card processing—also known as zero-cost processing—comes into play. By shifting the burden of credit card fees to the customer, this solution allows business owners to retain more of their earnings and invest back into their business.

In this article, we’ll explore how free credit card processing works, its benefits, and whether it’s the right fit for your business.

What is Free Credit Card Processing?

Free credit card processing, or zero-cost processing, is a payment solution that eliminates the fees typically paid by merchants for processing credit card transactions. Instead, the cost is passed to the customer through a small surcharge. This surcharge slightly increases the price for customers who pay with credit cards, while those who pay with cash are offered a discount through a cash discount program.

This approach helps businesses avoid the high costs of credit card fees, which can significantly impact profitability. However, it’s important to note that debit card payments are not subject to these surcharges, though cash discount programs can help eliminate those fees as well.

How Does Free Credit Card Processing Work?

The process is simple: when a customer chooses to pay with a credit card, a small surcharge (typically around 4%) is automatically added to their total purchase amount. For instance, if the original price of an item is $10, a credit card payment would increase the price to $10.40. The additional $0.40 helps cover the cost of processing the transaction.

This system benefits businesses by allowing them to avoid the cost of credit card fees altogether. Debit card payments, which usually carry lower interchange fees, are not subject to surcharges. Customers paying with cash can enjoy discounts, giving them more reason to choose cash over card payments.

By working with a provider like Haven Financial, businesses can easily implement a zero-cost processing program with minimal setup and paperwork, allowing them to start saving money right away.

Benefits of Free Credit Card Processing for Small Businesses

Implementing free credit card processing offers several key advantages for businesses:

- Retain More Earnings: When customers cover credit card processing fees through surcharges, businesses no longer need to absorb these costs, keeping more of their revenue.

- Predictable Pricing: Traditional credit card processing fees can vary, making it difficult for businesses to know exactly what they’ll receive after fees are deducted. With zero-cost processing, businesses know the exact price they’re receiving for each product or service, regardless of how the customer chooses to pay.

- Encourage Cash Payments: Offering discounts for cash payments incentivizes customers to use cash, further reducing fees associated with card transactions. This can be particularly beneficial for small businesses that handle frequent low-cost transactions.

- Easy Setup and Minimal Paperwork: With Haven Financial’s zero-cost processing program, businesses can enjoy quick approvals, month-to-month terms, and around-the-clock support, ensuring a smooth transition to the new system.

Can You Process Credit Cards Without a Fee?

While it may seem impossible to process credit cards without incurring fees, free credit card processing makes it possible. Although there are still processing costs, they are passed on to the cardholder via surcharges. This allows businesses to avoid paying fees for every credit card transaction, effectively making it a no-cost option for them.

This approach has become increasingly popular among small businesses looking to maximize profitability while still offering convenient payment options to their customers.

How to Offset Fees with Zero-Cost Processing

Free credit card processing works by automatically adding a surcharge to credit card payments. This surcharge is usually capped at 4% in most U.S. states. For example, if a customer purchases a $50 product using a credit card, the total amount they’ll be charged would be $52 (including the 4% surcharge). This way, the business doesn’t have to cover the processing fee, as the customer absorbs it.

One thing to keep in mind is that surcharges cannot be applied to debit card transactions. However, debit cards already have lower interchange fees, making them a more cost-effective option for many businesses.

What are the Lowest Credit Card Processing Fees?

When businesses opt for a traditional credit card processing model, fees can vary based on the type of transaction, card network, and other factors. However, with zero-cost processing, businesses can achieve the lowest possible fees—because the fees are passed on to the customer.

This system allows businesses to maintain their current pricing without having to inflate costs to cover processing fees. For industries with high transaction volumes, this can result in significant savings over time.

Is Free Credit Card Processing Right for Your Business?

Free credit card processing is a great option for many businesses, particularly those looking to reduce their operational costs. If you’re in a highly competitive market, you might need to consider how your customers will react to surcharges. In some industries, consumers have become accustomed to earning rewards from credit card use, so charging a surcharge might discourage card use.

However, for businesses that handle a high volume of small transactions, or those in industries where profit margins are thin, zero-cost processing can be a game-changer.

How to Stay Compliant with Zero-Cost Processing Laws

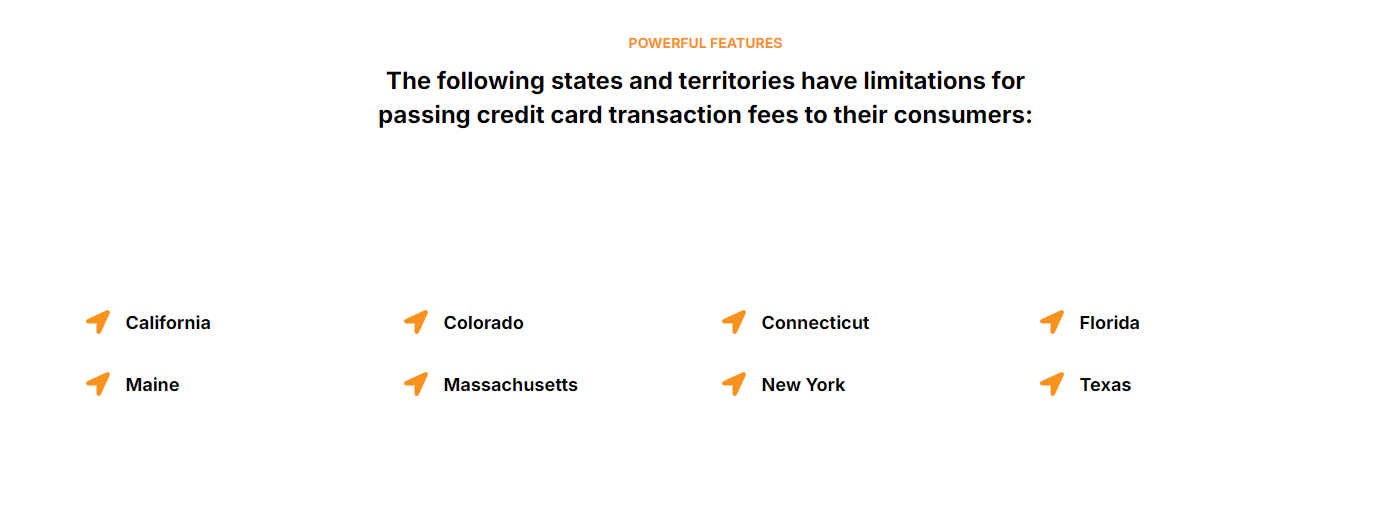

While free credit card processing offers many advantages, it’s crucial to stay informed about the laws regulating surcharges. Certain states, like California, Florida, and New York, have laws limiting or prohibiting the use of surcharges. If you’re located in one of these states, it’s essential to comply with the local regulations.

If surcharges are prohibited in your state, you can still benefit from a cash discount program. This alternative allows you to offer discounts for cash payments while keeping credit card prices at the original amount.

Haven Financial can help guide your business through these regulations to ensure compliance with all relevant laws.

Get Started with Free Credit Card Processing Today

Free credit card processing offers businesses an innovative way to save on transaction fees while maintaining convenient payment options for customers. If you’re ready to start saving and boosting your profitability, now is the perfect time to explore the zero-cost processing program offered by Haven Financial.

Contact Haven Financial today to set up your free credit card processing solution and take the first step toward maximizing your revenue.